Introduction

The Fintech Revolution India 2025 is reshaping how millions of Indians save, invest, and transact. From UPI payments to AI-powered loans and digital insurance, India has emerged as a global fintech powerhouse.

By 2025, India’s fintech industry is projected to reach a valuation of $150 billion, powered by strong digital infrastructure, regulatory support, and financial inclusion initiatives.

This article dives deep into the growth story, major players, government initiatives, and future trends that define India’s fintech revolution — and how businesses can tap into it for success.

1. Fintech Landscape in India

India is currently home to over 10,000 fintech startups, making it the third-largest fintech ecosystem in the world (after the US and UK). The fintech revolution began with the Digital India initiative, rapid smartphone adoption, and UPI’s success.

| Fintech Segment | Examples | Market Share (2025 est.) |

|---|---|---|

| Payments | PhonePe, Paytm, Google Pay | 46% |

| Lending | Cred, CASHe, ZestMoney | 24% |

| WealthTech | Groww, Zerodha, Kuvera | 16% |

| InsurTech | Acko, Digit Insurance | 8% |

| RegTech & Others | Signzy, Perfios | 6% |

(Source: PwC Fintech India Report, 2025)

2. Key Drivers Behind Fintech Growth

2.1. Digital Public Infrastructure (DPI)

The UPI (Unified Payments Interface), Aadhaar, and India Stack have transformed financial inclusion by connecting over 500 million users to digital banking.

2.2. Rising Smartphone Penetration

With over 900 million smartphone users, mobile-first fintech apps dominate both urban and rural markets.

2.3. Financial Inclusion Policies

Government programs like Jan Dhan Yojana and Digital Bharat Mission have brought millions into the banking system.

2.4. AI and Machine Learning in Finance

Fintech firms now use AI to assess creditworthiness, prevent fraud, and personalize user experiences.

2.5. Venture Capital & Startup Boom

In 2024–2025, fintech startups attracted $8.5 billion in funding from global investors, according to Inc42 Fintech Funding Report.

3. Major Players Leading the Fintech Revolution

| Company | Core Offering | Key Highlight |

|---|---|---|

| PhonePe | UPI, payments, insurance | 450M+ users, India’s largest payment app |

| Paytm | Wallet, loans, wealth management | Expanding Paytm Money & Paytm Bank |

| Cred | Credit card management, loans | 16M+ users, AI-based credit analysis |

| Zerodha | Stock trading | India’s #1 retail broker |

| Razorpay | B2B payments & APIs | Powers 8M+ businesses across India |

These companies symbolize how India’s fintech ecosystem blends innovation, scale, and financial inclusion.

4. Government Support & Regulation

The Indian government and RBI have built a pro-growth regulatory environment for fintech innovation:

- RBI’s Digital Banking Guidelines (2025): Encourage 100% digital-only banks.

- Fintech Innovation Hub: Promotes collaboration between startups and public banks.

- Digital Rupee (CBDC): India’s official digital currency, launched in pilot mode in 2024.

- Financial Data Empowerment Framework: Enhances user control over personal financial data.

These initiatives ensure security, transparency, and innovation coexist in India’s fintech future.

👉 Read official framework: Reserve Bank of India Fintech Guidelines

5. The Fintech Jobs Boom

The sector’s rise has created over 200,000 jobs across data science, cybersecurity, marketing, and compliance.

Top emerging job roles in 2025:

- Fintech Product Manager

- Blockchain Developer

- Financial Data Analyst

- Cybersecurity Engineer

- AI/ML Engineer for Risk Modelling

By 2026, the fintech job market is expected to grow by 35%, driven by global demand and Indian digital expertise.

6. The Future of Digital Payments

Digital transactions in India have grown exponentially:

- UPI transactions crossed 15 billion per month in 2025.

- Contactless and voice-based payments are on the rise.

- Cross-border UPI linkages with Singapore, UAE, and UK are expanding.

Innovations like UPI Tap & Pay, Wearable Wallets, and Voice-Enabled Payments are redefining convenience for consumers.

7. Fintech in Rural India: The Inclusion Engine

Fintech companies are bridging the rural-urban gap through microfinance and small-loan innovations.

- KreditBee and BharatPe enable local merchants to access credit.

- Navi Finserv offers instant personal loans to underserved markets.

- Airtel Payments Bank is expanding digital financial literacy to Tier 3 towns.

This inclusivity ensures fintech is not just urban, but truly pan-Indian.

8. Challenges & Opportunities

| Challenge | Description | Opportunity |

|---|---|---|

| Cybersecurity | Increasing fraud risk | AI-based fraud detection systems |

| Regulatory Hurdles | Frequent policy changes | Collaborative sandbox testing |

| Customer Trust | Data privacy concerns | Transparency and digital literacy |

| Market Saturation | High competition | Innovation & niche targeting |

Despite challenges, the market continues to grow rapidly due to technological resilience and government backing.

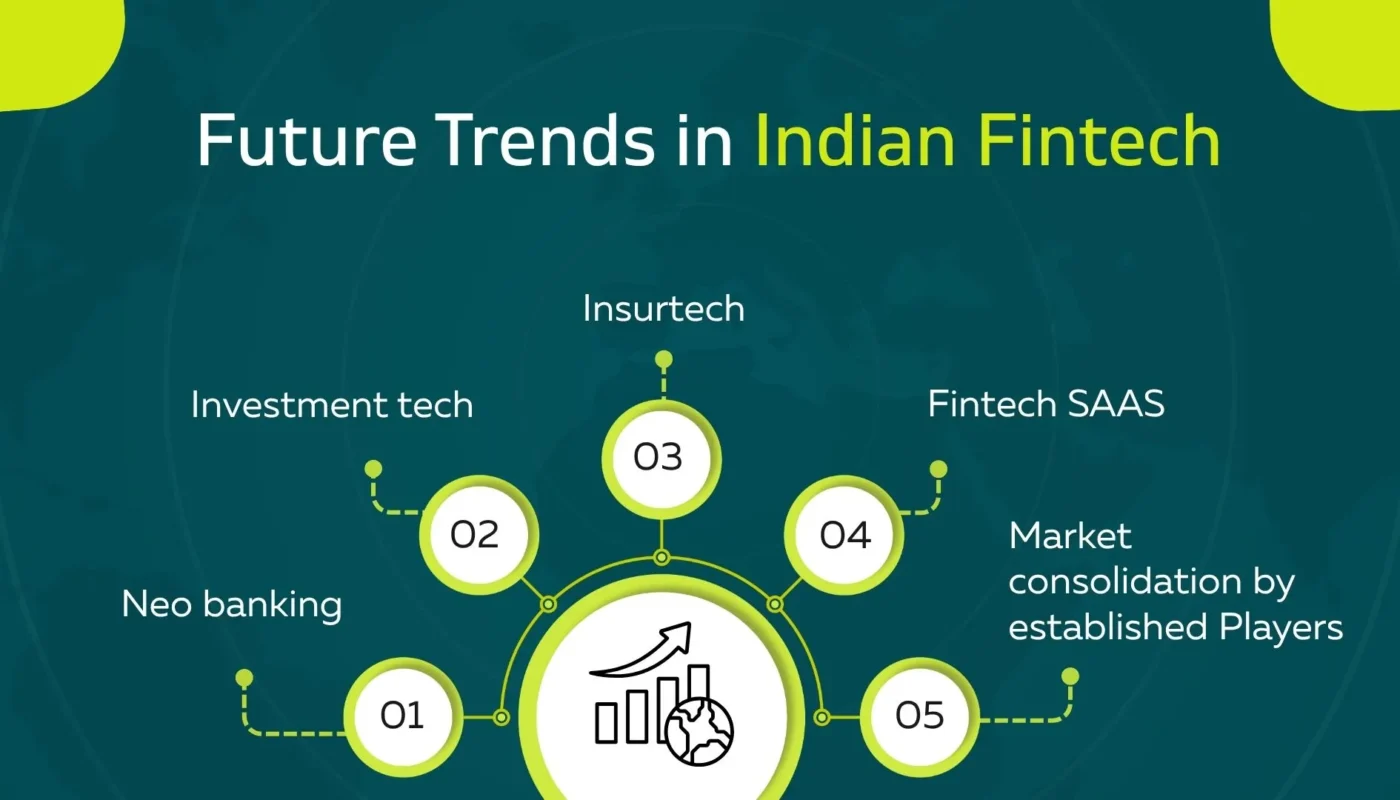

9. What’s Next for Fintech India 2025

- AI-Powered Personal Finance Assistants will dominate apps.

- Crypto & Blockchain Integration for faster settlements.

- Digital Rupee expansion for e-commerce and international payments.

- Green Fintech — financing renewable energy projects and ESG-based investments.

These developments ensure that India remains at the forefront of global fintech innovation.

Frequently Asked Questions (FAQs)

Q1: What is the size of India’s fintech market in 2025?

It’s estimated to reach $150 billion in valuation.

Q2: Which are the top fintech startups in India?

PhonePe, Paytm, Razorpay, Zerodha, and Cred are leading the ecosystem.

Q3: What are the major fintech job roles in demand?

AI engineers, cybersecurity analysts, blockchain developers, and data scientists.

Q4: How is the government supporting fintech innovation?

Through RBI sandboxes, Digital Banking Guidelines, and Digital Rupee trials.

Q5: Is fintech safe for consumers?

Yes, fintech companies operate under strict RBI and NPCI regulations ensuring user data protection.

Q6: What’s the future of UPI in India?

UPI is expanding globally, making cross-border payments seamless and cost-effective.

Conclusion

The Fintech Revolution India 2025 isn’t just transforming banking — it’s transforming lives. With financial inclusion, cutting-edge AI innovation, and global investments, India is poised to become a fintech superpower.

External References: